Electric vehicle (EV) maker Tesla sent an internal memo notifying staff that the company would be laying off more than 10 percent of its global workforce, Reuters reported Monday.

Read MoreCategory: Economy

Report: States with Low Taxes, Fewer Restrictions Tops for Economic Outlook

States with lower tax rates, lower debt and fewer government restrictions generally have stronger economic outlooks, according to the latest report that ranks states from best to worst based on how friendly their policies are to economic growth.

The American Legislative Exchange Council released its “Rich States Poor States” report Tuesday. The report ranks states based on “economic outlook” using 15 factors.

Read MoreAmericans Face Rising Gas Prices Again

Gas prices are steadily rising around the U.S. again, leaving many cash-strapped Americans struggling to keep up.

According to AAA, the current average price for a gallon of regular-grade gas nationally is $3.63. That is a sharp increase from $3.39 just one month ago. Crude oil prices have risen steadily over the last 30 days, from about $77 per barrel to $85 per barrel.

Read MoreElectricity Prices have Risen Seven Times Faster Under Biden than Trump

Electricity prices have experienced a significant rise since the beginning of the Biden administration, rising more than seven times faster than under the entire Trump administration.

The average price of electricity has increased by 29.4% since January 2021 as of March, far greater than the preceding four years under the Trump administration, when electricity prices increased by only 4.0%, according to the Federal Reserve Bank of St. Louis. The jump in electricity prices accompanies a number of policies from the Biden administration that have curbed energy production, such as a regulation from the Environmental Protection Agency that requires that existing coal-fired power plants cut their greenhouse gas emissions by 90% by 2040.

Read MoreFeds Borrowed $6 Billion Per Day So Far This Fiscal Year

The U.S. federal government has borrowed about $6 billion per day so far this fiscal year with little indication of slowing down.

The U.S. Treasury Department released its figures for the month of March showing it borrowed $236 billion in March alone, bringing the total to $1.1 trillion for this fiscal year, which runs from October to September.

Read MoreInvestors Scramble to Adjust Their Portfolios After Inflation Surge

Many investors are diversifying their portfolios from standard stocks and bonds as March’s inflation surge casts doubt on economy-boosting rate cuts from the Federal Reserve happening this year, according to Reuters.

The consumer price index increased to 3.5 percent year-over-year in March, up from 3.2 percent in February and far from the Fed’s 2 percent target. Markets prior to March’s inflation report anticipated a few rate cuts this year, leading investors to buy up stock in anticipation that markets would rise when cuts materialize, but the increasing possibility that the Fed will not cut rates this year has led investors to switch up their market strategy, according to Reuters.

Read MorePrices Edge Even Higher as Fed Chair Speculates If Inflation Is Really Under Control

Inflation jumped year-over-year in March amid speculation over whether the rate of inflation is really decelerating, according to the latest Bureau of Labor Statistics release on Wednesday.

The consumer price index (CPI), a broad measure of the price of everyday goods, increased 3.5 percent on an annual basis in March and 0.4 percent month-over-month, compared to 3.2 percent in February year-over-year, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained high, rising 3.8 percent year-over-year in March, compared to 3.8 percent in February.

Read MoreCommentary: High Gold Price Points to Sustained Inflation

The economy looms large in the minds of most people and not simply because it is an election year. It affects us directly. We spend a lot of our waking hours at work, and our jobs are often connected to the welfare of families and children. With everything being more expensive, getting a toe hold on mere middle-class status is harder now than it was for older generations. Many people are slipping down a rung or three.

In addition to long-term trends like the decline of manufacturing and the cut-throat financialization of corporate America, unique recent events loom large. COVID lockdowns, soon followed by the government money giveaway—PPP loans, augmented unemployment benefits, rent relief, and other stimulus plans—disrupted our routines and affected the entire economy. While these measures likely prevented a deep recession, the shutdowns ruined a lot of businesses, and the various stimulus funds ended up unleashing inflation.

Read More‘Million Dollar Cities’ on the Rise as Home Prices Climb

More cities have hit the $1 million mark amid rising home prices, especially in California.

A year ago, real estate marketplace Zillow found 491 cities where the typical home value was $1 million or more. That number grew to 550 cities this year, according to Zillow.

Read MoreInflation, COVID-Era Spending Policies Result in Teacher Layoffs Nationwide

School districts across the country are laying off teachers, citing high inflationary costs, budget deficits, and federal COVID-era funding running out after receiving windfalls in federal subsidies for three years.

The federal COVID-era subsidies were funded through ESSER (Elementary and Secondary School Emergency Relief) grants administered by state education agencies. Financed through the CARES Act and supplemental appropriations, the grant funding expires Sept. 30.

Read MorePart-Time Employment Surges for Another Month While Full-Time Falters

The number of Americans working part-time jobs surged in March, while full-time jobs declined slightly, according to data from the Bureau of Labor Statistics (BLS) released Friday.

There were 28,632,000 people with part-time jobs in March, 691,000 more than in February, when there were 27,941,000, according to the BLS. In that same period, the number of people employed in full-time positions dropped by 6,000, from 132,946,000 to 132,940,000.

Read MoreIncreased Crime Cutting into Small-Business Earnings, Survey of Owners Finds

One-third of small-business owners say increased crime is cutting into their earnings, and 7 in 10 grade President Joe Biden’s performance negatively in terms of helping small businesses, a new poll finds.

Pollsters John McLaughlin and Scott Rasmussen conducted the survey, along with the Job Creators Network Foundation in March, among 400 small-business owners. When asked about their sentiments regarding the state of the economy, 46% of small-business owners said the economy is getting worse, while just 27% said it’s getting better.

Read MoreCommentary: Job Program for Americans-No Jobs for Illegal Aliens, Period

I am weary of hearing the trope that we need more illegal aliens because “Americans won’t work those jobs.” My bet is that most Americans share this sentiment as well.

Amidst a myriad of concerns about illegal immigration, one prominent worry among Americans is the potential adverse effects on the U.S. workforce. There is apprehension that undocumented migrants could potentially displace native-born workers, leading to job loss and further exacerbating the nation’s tax burden. The media and the left love to dismiss such considerations as fearful, xenophobic, and bigoted, arguing instead that alien workers fill a vital gap in the American workforce. But these concerns, nevertheless, are valid.

Read MoreStudy Grades Natural Gas as Best Source for Reliability, Affordability and Environmental Impact

A new study finds that natural gas is the most effective energy source meeting growing energy demands affordably and reliably, while balancing environmental and human impact.

The “Grading the Grid” study by the Mackinac Center for Public Policy, a pro-free market nonprofit, and Northwood University rates natural gas, coal, petroleum, nuclear, hydroelectric, wind, solar and geothermal generation sources on their reliability, environmental and human impact, cost, innovation and market feasibility.

Read MoreAmericans Skipping Meals to Afford Housing Under Biden: Poll

A major real estate company released a survey on Friday which found that renters and homeowners are significantly reducing their quality of life to afford housing under President Joe Biden.

Nearly one in five homeowners and renters reported skipping meals to afford housing in Biden’s economy, according to a new survey conducted by Redfin. The median asking rental price increased from less than $1,700 when Biden took office in January 2021 to nearly $2,000 as of February, according to Redfin’s data.

Read MoreJob Market Continues Hot Streak Despite Persistent Layoffs

The U.S. added 303,000 nonfarm payroll jobs in March as the unemployment rate ticked down to 3.8%, according to Bureau of Labor Statistics (BLS) data released Friday.

Economists anticipated that the country would add 200,000 jobs in March compared to the 275,000 jobs that were added in initial estimates for February, and that the unemployment rate would remain unchanged at 3.9%, according to Reuters. The job gains are in spite of persistent layoffs that reached a 14-month peak in March at 90,309.

Read MoreCommentary: Under The Hood, the Jobs Report Is Not Strong

Looking under the hood of today’s jobs report shows it isn’t the home run that Democrats and the media claim.

Approximately half of the 303,000 jobs created last month came in the unproductive government or quasi-government healthcare sectors. These are not the types of jobs that drive growth and improve Americans’ living standards.

Read MoreLayoffs Surge to 14-Month High as Inflation Crushes Employers

The number of people laid off from American companies reached the highest point since January 2023, according to data from outplacement firm Challenger, Gray & Christmas, Inc.

American employers cut 90,309 employees in March, 7 percent higher than the 84,638 employees laid off in February and higher than the 82,307 positions cut in January, according to a report from Challenger, Gray & Christmas, Inc. The layoffs are in contrast to seemingly strong job gains, which totaled 275,000 in February, while the unemployment rate ticked up to 3.9 percent.

Read MoreCommentary: The Unattainable American Dream

Get married, have children, buy a house, and live comfortably on a single income. Not very long ago, that path was the reality, the norm, for the great American middle class.

But America has gone backward in this regard, and struggling citizens know it all too well. Experiencing the kinds of lives enjoyed by our parents and grandparents has become impossible for most Americans, leading to widespread disenchantment and a palpable loss of patriotism and confidence in America.

Read MoreElectric Vehicle Market Share Plummets in First Quarter as Consumers Sour

Growth in sales for electric vehicles (EV) slowed in the first quarter of the year as consumers remained wary of the product even though growth in sales of new vehicles remained strong, leading to a drop in EV market share, according to The Associated Press.

Sales for new vehicles grew 5 percent in the first three months of the year, but EV sales grew only 2.7 percent as more consumers chose traditional vehicles due to cost and product concerns, according to the AP. The average sales price declined 3.6 percent year-over-year to $44,186 in March as dealers looked to offload built-up inventory.

Read MoreGas Prices Creeping Higher Again as Election Cycle Heats Up

The national average cost of a gallon of gas at the pump jumped by 20 cents over the past month, according to AAA.

Currently, Americans are paying about $3.55 per gallon on average, up from about $3.35 a month ago, according to AAA’s data. Goldman Sachs, one of the largest financial institutions in the U.S., has recently cautioned that prices could surge above $4 per gallon by May, according to Yahoo Finance.

Read MoreBiden Admin Threw Billions at EV Charging Stations, But Only a Handful Have Been Built

The Biden administration’s well-funded push to build out a national network of electric vehicle (EV) chargers has so far resulted in only a handful of installations, according to The Washington Post.

The bipartisan infrastructure bill of 2021 allotted $7.5 billion to subsidize thousands of EV chargers to help the administration’s goal of having EVs constitute 50 percent of all new cars sold in 2030, but only seven stations in total have been built in four states to date, according to the Post. The slow rollout of the EV charger funding is unfolding as the Biden administration has recently issued stringent emissions standards for light-, medium- and heavy-duty vehicles that will result in significant increases of EV sales for all three classes of vehicle.

Read MoreCalifornia Fast Food Workers Face Layoffs as State’s $20 Minimum Wage Goes into Effect

All fast-food employees, regardless of age, will see a $20 an hour minimum wage in California, while the federal minimum wage is between $4.25 and $7.25, depending on age and length of time working.

California fast-food chains are laying off workers, raising prices and deciding against opening new stores as the state implements a minimum wage that is more than 175 percent higher than that required by the federal government.

Read MoreAT&T Resets Passcodes After 73 Million Current and Former Users Affected by Dark Web Leak

AT&T said that personal data from 73 million current and former users was leaked on the dark web and the phone giant has already reset the passcodes of millions of current customers who were impacted.

The data set, which appears to be from 2019 or earlier, was released on the dark web about two weeks ago, AT&T said Saturday.

Read MoreHome Cost Increases Doubling Those of Americans’ Incomes

The current cost of a median-priced home has now reached a rate of increase that is twice as high as the increase in the average American household income.

As the Daily Caller reports, the median monthly home payment for the month of February was $2,838, a 12% year-over-year increase. Meanwhile, the median household income is currently at $84,072, an increase of just 6% compared to last year. While the average income rate has roughly been on par with the cost of a new home for the last decade, the drastic change began in early 2022, when the average household income needed for a new home hit its current median of $113,520 a year.

Read MoreCompany That Operated and Staffed Ship That Destroyed Baltimore Bridge was Heavily Focused on DEI

The company in charge of operating and staffing the doomed vessel that destroyed the Francis Scott Key Bridge in a major crash earlier this week was heavily focused on Diversity, Equity and Inclusion (DEI) initiatives.

The Dali, the 948-foot vessel was managed by the Singapore-based Synergy Marine Group.

Read MoreGovernment Releases Another Batch of Data That Wipes Out Previous Economic Gains

New orders for manufactured durable goods, which serve as an indicator for longer-term investments from businesses and consumers, had a huge downward revision for January, following similar revisions seen in jobs data.

Orders for durable goods increased 1.4 percent in February to $277.9 billion, but January’s gains were revised down to -6.9 percent from an initial estimate of -6.1 percent, taking a huge chunk out of previously reported gains, according to data from the U.S. Census Bureau. The revisions for durable goods orders mirror revisions in employment figures, which have repeatedly reported high growth figures that are later revised down, most recently being revised down for January by 124,000 while job growth for February was reported as 275,000.

Read MoreContainer Ship Slams Baltimore’s Key Bridge, Officials Say Vessel Lost Power Just Before Impact

A container ship slammed into a Baltimore bridge early Tuesday, causing it to collapse and send vehicles and road crew members into a river in what authorities declared “a dire emergency.”

Read MoreVoters ID Inflation, Immigration as Top Concerns Ahead of Presidential Election

Likely voters are focused on inflation and price increases, illegal immigration and the economy as incumbent President Joe Biden and former President Donald Trump prepared for a rematch of 2020 in November.

The Center Square Voters’ Voice Poll, conducted in conjunction with Noble Predictive Insights, found that given a range of options to identify their top concerns, likely voters said inflation/price increases (45 percent), illegal immigration (44 percent) and the economy/jobs (24 percent) were the issues that matter most to them.

Read MoreState Financial Officers Urge Treasury to Terminate Internal Revenue Service’s ‘Direct File’ Program

A group of 21 state financial officers on Monday urged the Department of the Treasury to terminate the IRS’s Direct File pilot program, contending that its shortcomings were likely to lead to problems for filers, cause needless confusion, and result in lost state revenues.

Read MorePossible Bankruptcy for EV Maker Fisker as Industry Hit with Declining Consumer Interest

Electric-vehicle startup Fisker may file for bankruptcy as the declining pace of consumer demand weighs upon the struggling company.

In a March 15 8-K filing with the Securities and Exchange Commission, the company warned investors that “Fisker did not make a required interest payment of approximately $8.4 million payable in cash on March 15, 2024 (the “Interest Payment”) with respect to Fisker’s unsecured 2.50% convertible notes” and that “the Company has a 30-day grace period to make the Interest Payment.”

Read MoreCongress Probing Whether IRS Plyng AI to Invade Americans’ Financial Privacy

The House Judiciary Committee has opened an inquiry to whether the IRS is using artificial intelligence to invade Americans’ financial privacy after an agency employee was captured in an undercover tape suggesting there was a widespread surveillance operation underway that might not be constitutional.

Committee Chairman Jim Jordan, R-Ohio, and Rep. Harriet Hageman, R-Wyo., sent a letter last week to Treasury Secretary Janet Yellen demanding documents, and answers as to how the agency is currently employing artificial intelligence to comb through bank records to look for possible tax cheats.

Read MoreExisting Home Sales Jump 9.5 Percent in February

Existing home sales increased 9.5% in February to a seasonally adjusted annual rate of 4.38 million, marking the largest monthly increase since February 2023, but overall sales declined 3.3% from the previous year, according to the National Association of Realtors.

Total existing home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – jumped 9.5% from January to a seasonally adjusted annual rate of 4.38 million in February. Year-over-year, sales slid 3.3% (down from 4.53 million in February 2023).

Read MoreCommentary: Biden EPA’s Latter-Day Prohibition Targets Auto Industry

Not since Prohibition has the federal government sought to ban a product as popular as the internal combustion engine.

This week, the Environmental Protection Agency released its final emissions standards rule, requiring that 70% of new vehicle sales be pure battery-powered electric or hybrids by 2032.

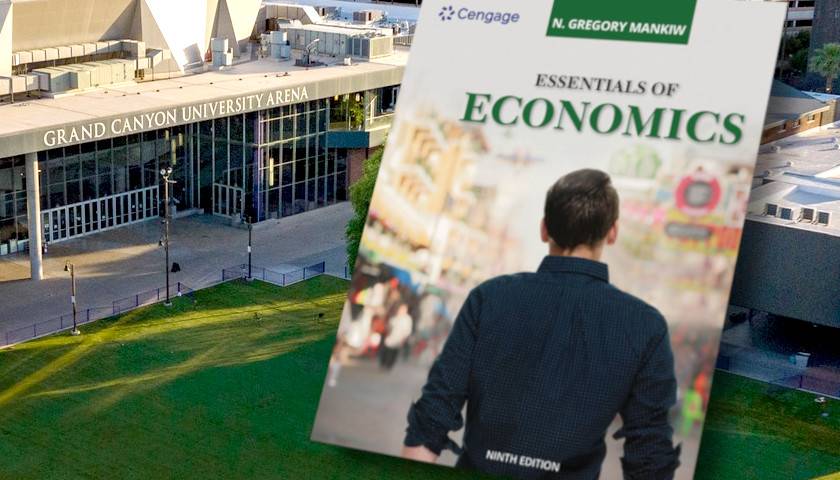

Read MoreGrand Canyon University Student Says She was ‘Silenced’ About ‘Biased’ Econ Textbook

A Grand Canyon University student says she has not been allowed to offer her opinions in class while her econ textbook is full of them.

Elizabeth Olson sent excerpts of the book, “Essentials of Economics” by Gregory Mankiw, to The College Fix and a syllabus showing it is being used for assignments and discussions throughout the course at the private Christian Arizona university.

Read MoreProgressives, Conservatives Not Happy with EPA’s New Rule on Vehicle Emissions

The U.S. Environmental Protection Agency said Wednesday it is finalizing more protective emissions standards that it called the “strongest ever” for light-duty and medium-duty vehicles that it claims will reduce air pollution and be phased in from 2027 through 2032.

In a news release, the EPA claimed the standards would result in a reduction of 7 billion tons of carbon emissions and have a net benefit of $100 billion in terms of public health benefits as well as reduced fuel costs and maintenance and repair costs for drivers.

Read MorePoll: 60 Percent of Independents Disapprove of Biden’s Job as President

A majority of Americans disapprove of the job President Joe Biden is doing, according to a new poll.

The Center Square Voter’s Voice poll released Wednesday asked voters, “When it comes to President Joe Biden, do you approve or disapprove of how he’s handling his job?”

Read MoreCBO Reports Grim Long-Term Outlook for Federal Government

The Congressional Budget Office on Wednesday released a bleak outlook for the federal government with new projections that show debt levels will reach their highest levels ever in five years.

“Debt held by the public, boosted by the large deficits, reaches its highest level ever in 2029 (measured as a percentage of GDP) and then continues to grow, reaching 166 percent of GDP in 2054 and remaining on track to increase thereafter,” according to the CBO report. “That mounting debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices.”

Read MoreEnergy Secretary Insists Energy Stockpiles Will Be Refilled in 2024, but Experts are Skeptical

Energy Secretary Jennifer Granholm said Monday that the nation’s energy stockpiles, which President Joe Biden depleted to its lowest level since the 1980s, will be refilled by the end of 2024.

“By the end of this year we will essentially be back to where we would have been absent the sales,” Granholm said at the CERAWeek energy conference in Houston, Texas, according to AFP.

Read MoreBentley Pushes Back Ambitious All-Electric Goals

British luxury carmaker Bentley Motors is pushing back its plans to have an all-electric vehicle (EV) offering by 2030, following other top vehicle manufacturers, according to CNBC.

Bentley had originally planned to transition all of its vehicle sales to EVs by 2030 but announced that it would be looking to delay that change by a couple of years, continuing to offer hybrids through that time, CEO Adrian Hallmark said in a media briefing following the company’s fourth quarter results, according to CNBC. General Motors, Ford, Mercedes-Benz and Honda have all backed off of previously made EV goals in the past year as low demand and high costs have stifled the commodity’s profitability compared to traditional vehicles.

Read MoreLayoffs Continue Nationwide as Economic Concerns Rise

As the economy worsens, multiple industries continue to shed jobs.

U.S.-based companies laid off 82,307 employees in January, a 136 percent increase from the previous month, according to a report by the business and coaching firm, Challenger, Gray & Christmas, Inc. The Wall Street Journal reported companies are still cutting white-collar jobs in an attempt “to do more with less.”

Read MoreRetailer Joann Fabrics Files for Bankruptcy as Americans Cut Back on Creature Comforts

Major fabric and craft retailer Joann announced Monday that it was filing for bankruptcy as consumers pull back on spending due to harsh economic conditions.

The retailer recently reached an agreement with a majority of its financial stakeholders as well as other financing parties, giving the company around $132 million in new financing while also reducing the debt on the company’s balance sheet by around $505 million, according to an announcement from Joann. Retail sales across the U.S. economy have continued to slump in recent months, growing just 0.6 percent month-to-month in February, not including inflation, and declining 1.1 percent in January as consumers pull back on non-essentials as prices rise.

Read MoreJeff Bezos’ Charity Spending Millions to Fund Development of Fake Meat

The charitable foundation of Amazon founder and billionaire Jeff Bezos is pouring tens of millions of dollars into efforts to advance synthetic meat.

The Bezos Earth Fund (BEF) will be spending an initial $60 million to fund research and development of “alternative proteins,” which the University of Melbourne defines as “plant-based and food-technology alternatives to animal protein,” the BEF announced Tuesday. The $60 million commitment is part of the BEF’s $1 billion campaign to transform food systems to fight climate change.

Read MoreInflation in Phoenix Area Slows Down

Inflation in the Phoenix metropolitan area appears to be calming down, according to new Consumer Price Index data from February.

The CPI saw an uptick of 2.2% year-over-year from last February, and a 0.7% increase between December 2023 and this February. That’s lower than the nationwide year-over-year rate of 3.2%.

Read MoreCommentary: Electric Transmission Buildout Could Cost Americans Trillions of Dollars

Though windmills and solar panels get the headlines, the big energy topic in Washington is electric transmission. Whether it is Congress’s newfound interest in permitting reform, the U.S. Department of Energy’s new Grid Deployment Office, or the Federal Energy Regulatory Commission’s (FERC) upcoming final rule on transmission planning and cost allocation, how to build and pay for long-range transmission to connect generators to customers is considered the final piece in the quest to meet net-zero goals.

Like so many issues in Washington, the need for more transmission lines is accepted without question and the costs are not considered. But for American consumers, especially low-income and elderly, as well as small businesses and energy intense manufacturers, building new transmission lines could result in much higher monthly bills and leave them on the hook for stranded assets.

Read MoreStudy: Most Partial Automation Driving Systems Need Work

The Insurance Institute for Highway Safety says automakers should incorporate new rating programs into their partial driving automation systems to reduce traffic deaths.

The new IIHS ratings aim to encourage safeguards that can help reduce intentional misuse and prolonged attention lapses.

Read MoreInflation Woes: Home Buyers Need 80 Percent More Income to Buy than Four Years Ago

The housing market is not immune from inflationary woes as buyer’s purchasing power has significantly diminished in four years. Home buyers in 2024 need 80% more income to purchase a home than they did in 2020, according to a new report by Zillow.

“The income needed to comfortably afford a home is up 80% since 2020, while median income has risen 23% in that time,” the report states. That equates to $47,000 more than four years ago.

Read MoreFamily Dollar and Dollar Tree to Close 1,000 Stores After $1.71 Billion Net Loss

Dollar Tree and its subsidiary, Family Dollar, will close 1,000 stores following a net loss of $1.71 billion over three months, the discount retailer said Wednesday.

The company plans to close about 600 Family Dollar stores in the first half of this year and allow about 370 Family Dollar stores and 30 Dollar Tree stores to close over the next few years at the end of their lease terms.

Read MoreSedona Designates ‘Safe Place to Park’ for Homeless Arizonans Living in Vehicles

The Sedona City Council voted on Tuesday to designate an area for homeless Arizonans who live in their vehicles to park overnight.

In a decision proponents presented as a partial solution to the city’s housing crisis, the city council voted to allow residents to park and stay overnight in an unpaved parking area that formerly served Cultural Park, which closed in 2004.

Read MoreSemiconductor Giant Faces U.S. Delays While Racing Ahead in Japan amid Biden Chips Funding Uncertainty

A major Taiwanese chip manufacturer’s plan to build a key factory in the U.S. has been plagued with significant delays. Meanwhile, the chipmaker is on schedule to open a separate facility in Japan.

One of the plants Taiwan Semiconductor Manufacturing Company (TSMC) is building in Arizona has delayed manufacturing until 2027 or 2028 instead of 2026 because of uncertainty regarding funding it will receive from President Joe Biden’s administration, according to The New York Times. TSMC’s factory in Japan is on track to operate on schedule as the country’s government has helped the factory by committing billions in funding and assisting with assembling thousands of employees to build it, the WSJ reported.

Read More